Welcome to Money Diaries, where we’re tackling what might be the last taboo facing modern working women: money. We’re asking millennials how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a Corporate Communications Manager who makes $85,000 per year and spends some of her money this week on a wood wick candle.

Occupation: Corporate Communications Manager

Industry: Real Estate

Age: 26

Location: Salt Lake City, UT

Salary: $85,000

Paycheck Amount (Biweekly): $2,150

Gender: Woman

Monthly Expenses

Mortgage: $1,050 (My 20-year-old cousin is living with me currently and covers the $250 HOA fee.)

Loans: $0 (Luckily I had good scholarships and jobs through college. Plus my car was cheap and is paid off.)

Savings: $1,200

Tithes and Offerings: $480

Electric/Gas: $50

Barre Class Membership: $80

Car Insurance: $35

WiFi: $30

Cell Phone: $0 (my work expenses it)

Hulu: $12 (my parents, two brothers, and I split Netflix, Amazon Prime, and Disney+)

Spotify: $10

Cinemark Movie Pass: $10

Spa Membership (Massage/Facial 1x/month): $50

Day One

9 a.m. — I wake up Sunday morning for breakfast. Luckily my cousin, C., who is living with me, does a lot of cooking and cleaning in exchange for cheap rent — she pays $250 a month and normally rent for a room in our neighborhood would be closer to $650 — so I get a delicious and free egg and avocado breakfast sandwich. Totally worth it to me! I bought a house with a guest bedroom and I usually prefer to live alone, but after C. broke up with her long-term boyfriend and needed a new start, I let her move in for cheap a few months back. It’s been surprisingly nice for both of us, and while I originally planned on it being temporary —I thought she’d go back to the boyfriend honestly — I think our roommate situation could be good long-term.

11 a.m. — C. and I go to church. We have a lot of friends in the congregation, so it’s a good way to see everyone. We spend time after the service just chatting and catching up with my group of friends. While most of my friends are closer to my age (26), they’re all more in the same stage of life as C. (20). I’m really the only homeowner of the crew and out of the group of 10 single guys and girls, I think I am only one of two or three with a really steady career. Outside of my church friends, it seems like this is the case with most of my friends: They’re either married and really settled with a house, career, and kids or they’re working as bartenders and living in a place with the cheapest rent possible. I am in a weird in-between that occasionally feels isolating.

9 p.m. — On Sundays, I don’t spend any money. It feels like the easiest way to disconnect for a day. So for the rest of the day, C. and I cook lunch and dinner. I take my dog on a long walk. I start rereading a Tamora Pierce book I read when I was 12 (I know I should read something else, but it’s just weirdly comforting to me to reread these books). Some friends, N. and H., come over and we play Mario Kart. N. brings his Switch and we do this most Sunday nights. I don’t even like Mario Kart, but somehow this became our tradition and we stick with it. N. and H. are just classically extroverted guys who have to hang out with people constantly — it makes being their friend very easy. While we are all single, none of us have ever dated each other and I don’t think we ever would.

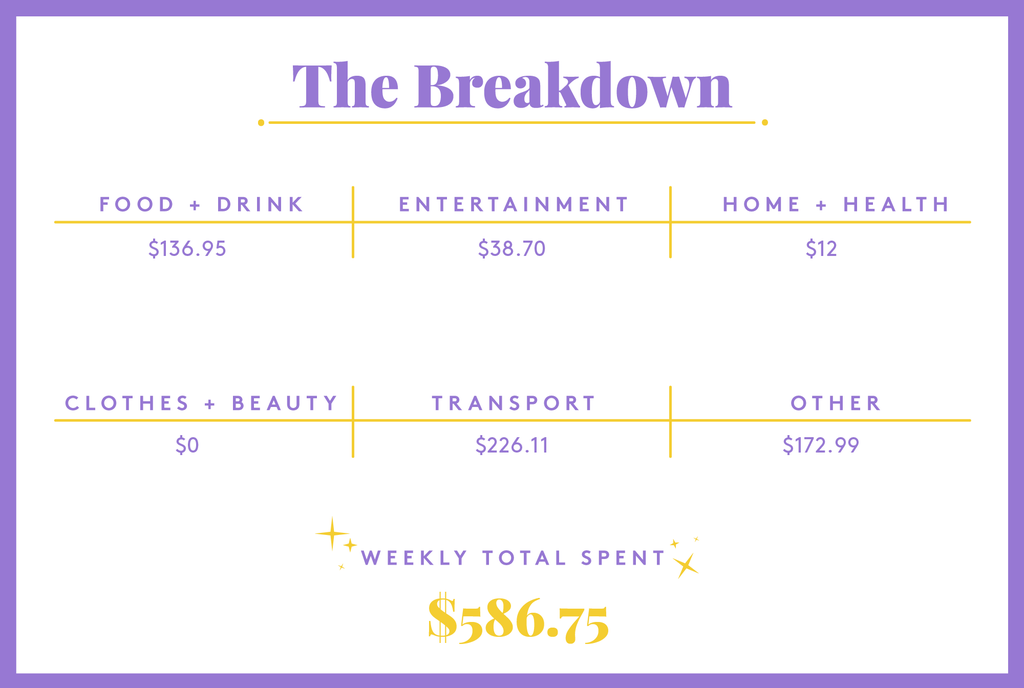

Daily Total: $0

Day Two

8 a.m. — I wake up at 6:45 and go to my 7 a.m. barre class. I’m very fast at getting out of bed and into my car in the mornings, which means I never look very put together, but it’s just not a priority for me. My barre studio is stupid expensive but I like it and it’s right between my house and my work so it’s perfect. After class, I shower at the studio quickly, get dressed for work, and swing by Starbucks for a chai and a bacon gouda sandwich for breakfast. I am trying to do this less and just bring a granola bar and fruit in the mornings… but I never do. $9.31

11 a.m. — I get to work and get to my desk. I typically have a bunch of projects right in the morning, keeping my first few hours super busy. Once I’m caught up, I can usually give myself a mental break. Because my work is mostly writing and strategic planning, I need my creative energy, which means I can’t just go at 100% energy 100% of the time. I have a quick break and I jump on Amazon to order a book I’ve been looking for. It’s Eduardo Galleano’s Book of Embraces. I’ve been trying to find it at local bookstores and I just can’t, so I finally give up and turn to Amazon. It’s one of my favorite books, but I think my ex-boyfriend stole my copy after we broke up. So I need to replace it. He was so dramatic, thank goodness that’s done. $26.71

1 p.m. — I live close to my office so I usually take my full hour lunch break, drive home, and eat there. It’s a good brain-refill moment for me, plus I get to check on my dog and play with him a bit outside. On my drive there, I call my dad and do a little check-in. Then, I make a panini and we play fetch outside for literally five minutes before I get too cold and quit. My dog deserves better, but I am what I am. On the drive back, I call my brother. I usually call family members each drive because I really love my family. We all stay pretty close, so this is an easy way to fit in moments with each of them.

6 p.m. — My little brother lives a few towns over. He picks me up from work and takes me to a law school wine and dine event. My little brother is 22 and planning to start law school in August, but until he decides where to go, he’s got a handful of places courting him and mostly that means taking him to dinners. He would usually take his girlfriend, but she had to work tonight, so I get asked to sub in. I don’t mind because its free food and decent networking. Plus my little brother is very social and good in those environments, so it’s chill. I am really proud of him and will show up to anything he asks me to. After the long dinner, we go to my house and hang out with C. I go to bed at 10 p.m. I love to get a full night of sleep.

Daily Total: $36.02

Day Three

7 a.m. — I wake up but don’t go to my usual morning barre class. I work from my bed from 7-8, then get up, get ready, and leave for work. I swing by a cute shop for an açai bowl. Again, I could cook my own breakfast, but I don’t. $12.63

11:30 a.m. — After another busy work morning, I take an early lunch and go pick up my dog and take him to the vet. I’ve had him for a little over a year, and it’s time for him to get his vaccines updated. He’s a very cute mid-sized dog and I love him the most. However, he’s not particularly smart. He does a great job at the vet and is weirdly obedient (for him) and I’m just so proud. I bet this is how my mom felt when she’d hang my art on the fridge. I was planning to just skip lunch and eat some snacks from my office breakroom to hold me over, but it turns out the team next to me ordered too much catered lunch, so I get free lunch! $85

6:30 p.m. — After work, I stop by the grocery store to stock up. I’m trying to eat at home more, but I hate grocery shopping. I usually go about every other week. I stock up on food to make lunch and dinner and pretend to buy things for breakfast even though I know I won’t eat breakfast at home and I’ll just eat it as snacks on weekends. $75

8 p.m. — I rent Sing Street because I can’t find it on any of the FOUR streaming services I have access to and I want to rewatch it with C. and her friend, K. They met a couple of weeks ago and they’re definitely both still trying to play it cool, but they’re in love and will probably be officially dating by next week. C. always moves very fast into serious relationships, and always has since she was a kid. Sing Street is one of my favorite movies, and like I do in most movies, I cry a little too hard. $2

Daily Total: $174.63

Day Four

6 a.m. — I do it! I eat the food in my house for breakfast! A granola bar and a banana actually make it into my car with me as I whirlwind out of my bed in the morning and make it to barre class at 7 a.m. I’m glad you got to witness it. After barre, I head straight to work and weirdly don’t have a million things to do this morning. So I take the time to goof off online and not do any work. I could be working on some long-term projects, but I just don’t. While my mornings are busy with work, my afternoons are almost always full of meetings. I don’t mind that schedule. I have a lot of autonomy at work and as long as everything gets done and published, no one really bothers me.

12:30 p.m. — I’m so proud of myself for not eating out for breakfast, that I grab a salad from Kneaders on my way home for lunch. I hate making salads at home because it takes so much effort for so little reward. On the way home, I call my sister-in-law. I’m trying to get her and my brother and their baby to come visit me for a weekend. They live in a rural town about four hours away. She’s going to look at their calendar and schedule a weekend. At home, I play with my dog and eat my salad while listening to Reply All (a podcast). I don’t like going to lunch with people because lunch is my quiet recharge time. While I can perform like an extrovert when I need to, I really need that introvert-alone-recharge-time to function. $9.19

6 p.m. — I’m supposed to meet up with four friends for dinner, but I bail because I love canceling plans. My friends have known me for years, so they know I’m a bad friend and they’re cool with it. Instead, I go home, heat up some gnocchi I bought yesterday, and just cuddle with my dog and finish reading my book. Instead of doing something productive, like study for the GRE (I want to go back to grad school but keep stalling), I play this dumb Harry Potter game on my phone. I always run out of “energy” and I’m stupid and do an in-app purchase. This is a very dumb way to spend my money and I hope I get roasted for it in the comments. $9.99

Daily Total: $19.18

Day Five

9:30 a.m. — Well. This is unexpected and bad. It turns out last night I left my light on in my car. And since my car is very bad and old, the battery died to the point where my fob won’t unlock it. The key to my door is broken because again, my car is bad and old. My commute is short, so I don’t really think about how bad my car is until stuff like this happens. I can’t get in, even though I break two metal hangers trying to get in through the window. I finally give up and call a locksmith. I know all locksmiths are expensive scams and to ask for a price upfront due to a recent podcast I listened to… but I don’t do that because I’m in a panic. I wait 20 minutes for the technician to show up. He has my car door open in five minutes. I get charged $180 for the interaction. UGHHHHH. I’m also now very late to work, which just sets my whole day back. I end up working through lunch to catch up. $180

5 p.m. — I have had a bad day, so I stop at Arby’s and get dinner. I get a bunch of mozzarella sticks. Arby’s mozzarella sticks are not good, but they are my favorite comfort food. I love them. If I could only choose one fast food restaurant to eat at it and the rest were off-limits for me, I’d choose Arby’s. I think this says a lot about me as a person and none of it is good. $9.64

7 p.m. — After I get home, I clean my house a bunch and chat with C. She and K. are officially dating now! Called it! I like K. and they seem good together, so this is good news. Once laundry and dishes are done, I get online and order a kit with the tools the locksmith used to get into my car. It’s barely $40!!!!! I could definitely do it myself. My door handle will remain broken, but this will be a solid back up plan for if I’m an idiot and kill my car battery again. Obviously, I let the morning unhappiness color my entire day. I go to sleep and dream about reasonably priced locksmiths. $46.11

Daily Total: $235.75

Day Six

8 a.m. — Back on my bullshit. After barre this morning, I swing by Starbucks and get breakfast. It’s just so conveniently located! $8.83

11:30 a.m. — One of our executives did an interview in an industry publication without my knowledge, which makes me a bit upset at work. Like, let me help you! It’s in a weird publication that, strangely, I don’t have a subscription to. So I subscribe for the year, it cost $40, but I’ll expense it. I’ve been at this job for just over a year now, and overall the people here like me and like my work — I got a raise not even six months on the job. But there are some areas I just am still working on gaining the team’s trust in. Media Relations seems to be the big one. After this, I run home for lunch, make a sandwich, snuggle the dog, and feel better on my way back to the office. I call my dad and we talk about my taxes. He’s incredibly good with money and has always encouraged our family to speak openly about our finances. I think I’ve learned everything from him. ($40 expensed)

6 p.m. — I head home, and decide to do my taxes with TurboTax. I hate that I don’t know enough to do my taxes completely by myself. From a podcast, I also learned about how all these tax companies and their lobbying are the reason we don’t just have a free, simplified website where the government just tells you how much you own. So I do it begrudgingly. This year I bought my house and sold some stocks I had invested in (my dad always made me invest some portion of my high school paycheck into the stock market so I could learn about it. Honestly, it helped me a lot! Would recommend to parents). It’s a bit complicated to do my taxes but it still only takes me an hour. Again, with my dad’s help, I upped my dependents on my W4 this year even though I have no dependents and it landed just perfectly. I am only getting $100 in my tax return, which means I didn’t overpay my taxes all year. I’m pretty shocked that it turned out so well. $39.99

8 p.m. — My friend, T., comes over to hang out with my dog. She then secondarily hangs out with me. We realize we want to buy new candles so we briefly leave our house to go to Target and buy new candles. I go with a wood wick candle. What a thrilling life! $12

Daily Total: $60.82

Day Seven

10:30 a.m. — I get up and go to barre class. T. meets me for barre today and after we grab açai bowls together. After barre, I go home and take the dog on a long walk to the dog park where he plays for an hour or so. After I get home, I give the dog a bath and take care of some of the household chores. I hate housework and I am consistently spending under my budget each month enough that I’ve thought about hiring a service to help, but I just feel like that is so wasteful! I mean, C. already cleans a bunch for me, I barely do anything and I still complain like it’s too much. If I ever did hire a cleaning service, I can just hear my mom calling me out for being so excessive. So, I’ll just clean and be mad about it. $12.35

5:30 p.m. — My little brother’s best friend is getting married tonight. The wedding has dinner and dancing and is a blast! I love dancing at weddings, although I always dance too hard and look like a dork, so I do not have any interested suitors after the event, even though the bride and groom both have so many cute friends. I love celebrating with everyone and it’s a good end to the week! The wedding shuts down kind of early, which is actually nice since I have to drive home still.

11:56 p.m. — I realize I forgot to buy a wedding gift, so I get on the online registry once I get home and grab a set of camp cooking gear that hadn’t been purchased yet. I should not have forgotten about getting them a gift! Now my gift seems especially random! I hope they won’t notice it’s late. But even if they do notice, once again, my friends already know I’m a bad friend and they love me anyway. I am very lucky! $48

Daily Total: $60.35

Have you been to a bachelorette party recently and had to foot (at least part of) the bill? We want to hear from you about your recent experiences with bachelorette parties and finances. Fill out this form for a chance to be featured in an upcoming story.

Have you ever ended a friendship over money? Is there a money faux pas your friends commit that drives you crazy? Share your experience here and you could be part of an upcoming Refinery29 story.

Money Diaries are meant to reflect individual women’s experiences and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here: r29.co/mdfaqs

Like what you see? How about some more R29 goodness, right here?

A Week In Baltimore, MD, On A $28,000 Salary

A Week In New Orleans, LA, On A $65,000 Salary

A Week In Minneapolis, MN, On A $54,000 Salary